- Live Life Grow Wealth

- Posts

- "Unlock Top Investing Secrets! VectorVest’s Blog Reveals Pro Tips for Smart Market Moves!"

"Unlock Top Investing Secrets! VectorVest’s Blog Reveals Pro Tips for Smart Market Moves!"

Introduction

Hello everyone,

Welcome to this week’s edition! Building wealth and securing your financial future doesn’t have to be overwhelming—it’s about making small, smart decisions and sticking to proven strategies. If you're ready to take meaningful steps toward your goals, this issue has everything you need to get started.

Here’s what you’ll find inside:

Top Stock Pick of the Week: Don’t miss this week’s spotlight on a promising stock with strong growth potential. Adding this pick to your portfolio could be a game-changer.

Build Wealth with Smart Habits: Discover simple but powerful habits that can set you on a path to long-term financial success.

Avoid Common Investing Mistakes: We’ll discuss the top missteps many investors make and how you can steer clear to protect your investments.

Plan for a Secure Future: Get insights into retirement and legacy planning to make sure your future needs are covered.

Diversify for Stability: Learn how diversification can bring balance to your portfolio and help you weather market shifts confidently.

Each section is packed with actionable tips that will make a real difference on your wealth-building journey. So, grab a coffee, settle in, and let’s dive into this week’s strategies!

Happy reading and investing!

Top Stock Pick of the Week

Tesla Inc. (TSLA) has emerged as a compelling stock pick for the week of November 11, 2024, due to several key factors:

1. Strong Financial Performance

Tesla's recent financial results have exceeded market expectations. In the third quarter of 2024, the company reported a net income of $2.17 billion, or 62 cents per share, up from $1.85 billion, or 53 cents per share, a year earlier. This robust performance underscores Tesla's ability to scale operations and maintain profitability.

2. Market Leadership and Expansion

Tesla continues to dominate the electric vehicle (EV) market, holding a significant market share. The company's expansion into global markets, advancements in autonomous driving technology, and commitment to renewable energy have positioned it as a unique player in the automotive landscape.

3. Positive Market Reaction to Political Developments

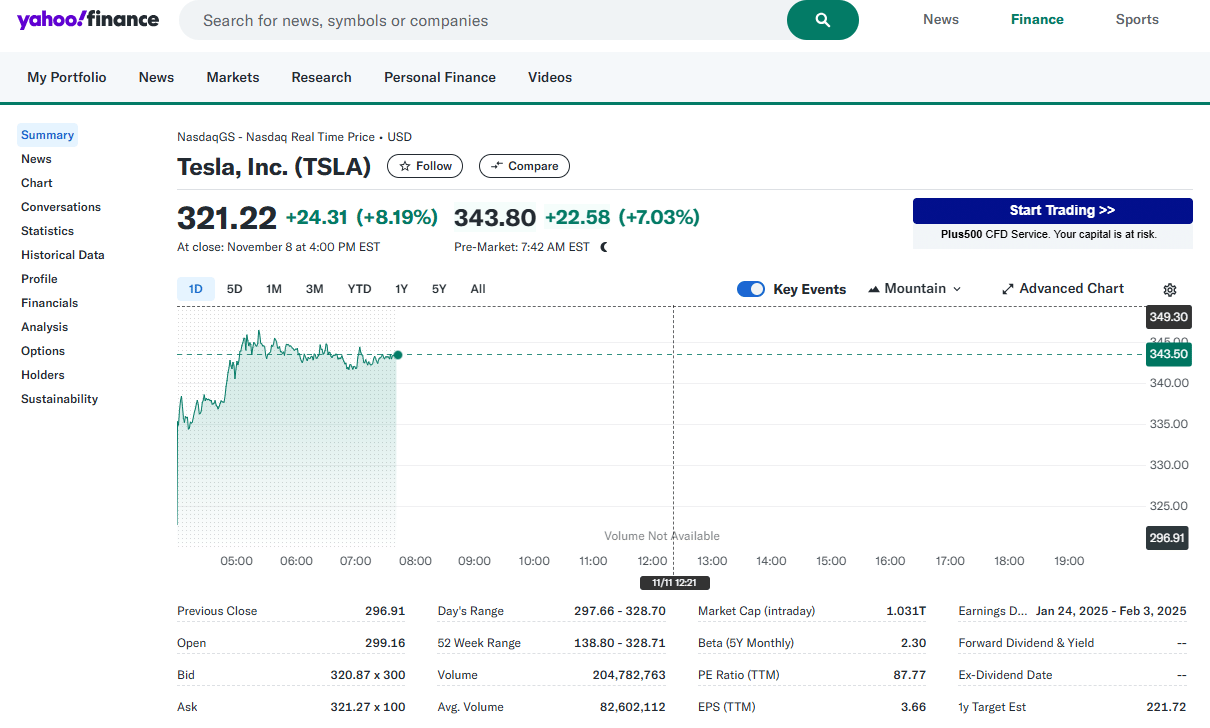

Following the recent U.S. presidential election, Tesla's stock surged by 14%, reflecting investor optimism about the company's prospects under the new administration. Analysts believe that a Trump presidency could expedite regulatory approval for Tesla's autonomous driving technology, which is crucial for the company's future projects like robotaxis.

4. Analyst Upgrades and Price Targets

Several analysts have raised their price targets for Tesla, citing the company's strong performance and growth prospects. For instance, Wedbush Securities analyst Dan Ives reiterated an outperform rating on Tesla shares and raised the price target from $310 to $350.

5. Technical Indicators

From a technical analysis perspective, Tesla's stock has shown strong momentum. The stock has risen by 15.09% compared to the previous week, and the month change is a 21.90% rise. Over the last year, Tesla has shown a 46.18% increase.

In summary, Tesla's strong financial performance, market leadership, positive reaction to political developments, analyst confidence, and favorable technical indicators make it a top stock pick for the week.

Valuable Resources

Master the market in 5 minutes per day

Hot stock alerts sent directly to your phone

150,000+ active subscribers and growing fast!

Extra Insights

Dive into expert strategies, market insights, and essential tools to sharpen your investing skills and boost your portfolio.

Discover key wealth-building habits to boost your net worth, secure your financial future, and make your money work for you

Learn the most common investing pitfalls and smart strategies to protect your portfolio and maximize returns.

Learn the essential steps to calculate your retirement needs and secure the lifestyle you’ve always dreamed of.

Learn how spreading your investments can reduce risk and boost returns, helping you build a stable, growth-focused portfolio.

Final Takeaways

As we wrap up this edition, I want to share some practical advice to keep you on the path to financial success. Building wealth is about making smart choices consistently, even if they seem small. I’ve seen friends make incredible progress by developing simple wealth-building habits—and they all started with just a few basic steps.

Here are some key takeaways:

Stick to good habits: Small actions, like regularly reviewing your investments and setting aside money for the future, can add up. People I know who’ve built solid wealth did so not by getting lucky but by staying consistent.

Watch out for common mistakes: Avoid pitfalls like chasing trends or not doing enough research. I’ve seen people make impulsive decisions that led to setbacks, while those who took time to plan reaped long-term rewards.

Plan for the future: Retirement and legacy planning aren’t just for later—they’re for now. Start early, even if it’s small. A friend once shared how glad he was to have started saving in his 20s, knowing his future was secure.

Diversify your portfolio: Having a mix of assets can protect your investments during market changes. I’ve learned firsthand that diversification is key to a stable portfolio.

And don’t forget to check out this week’s Top Stock Pick! Adding well-researched picks to your portfolio can provide growth opportunities that align with your goals.

Keep taking these steps. Wealth-building isn’t about making big moves fast; it’s about staying steady and purposeful. Let’s keep growing together, one choice at a time!

[Live Life Grow Wealth]