- Live Life Grow Wealth

- Posts

- "Top 2 Stocks to Watch This Week: NVIDIA and Amazon Set to Soar!"

"Top 2 Stocks to Watch This Week: NVIDIA and Amazon Set to Soar!"

Introduction

Hello everyone,

Welcome to this week’s edition! Life’s financial surprises are unavoidable, but with the right preparation, we can turn uncertainty into opportunity. Today, we’re diving into strategies for building financial resilience, from creating an emergency fund to planning for a secure future.

Before we get into that, let’s spotlight this week’s Top Stock Pick: NVIDIA Corporation (NVDA). NVIDIA continues to dominate the AI chip market, with analysts anticipating a stunning 82% YoY revenue surge for Q3 2024. With its Blackwell AI chip driving innovation in autonomous vehicles and text-to-video applications, NVIDIA commands 95% of the AI training chip market, cementing its leadership in this transformative sector. For those looking to diversify and capitalize on the AI boom, NVIDIA is a standout pick.

Additionally, Amazon.com Inc. (AMZN) is making waves as a stock to watch, with strong earnings, cloud computing growth, and strategic innovations like “Amazon Haul.” It’s no wonder analysts see a 19% upside for this e-commerce powerhouse.

In this edition, we’ll also explore how to create a solid financial foundation through smart habits, avoiding common mistakes, and effective diversification. Whether it’s protecting against life’s surprises or identifying opportunities for growth, you’ll find actionable advice to help you build a stable, resilient financial future.

Let’s dive in and take these steps together!

Happy reading and investing!

My Top Stock Pick of the Week

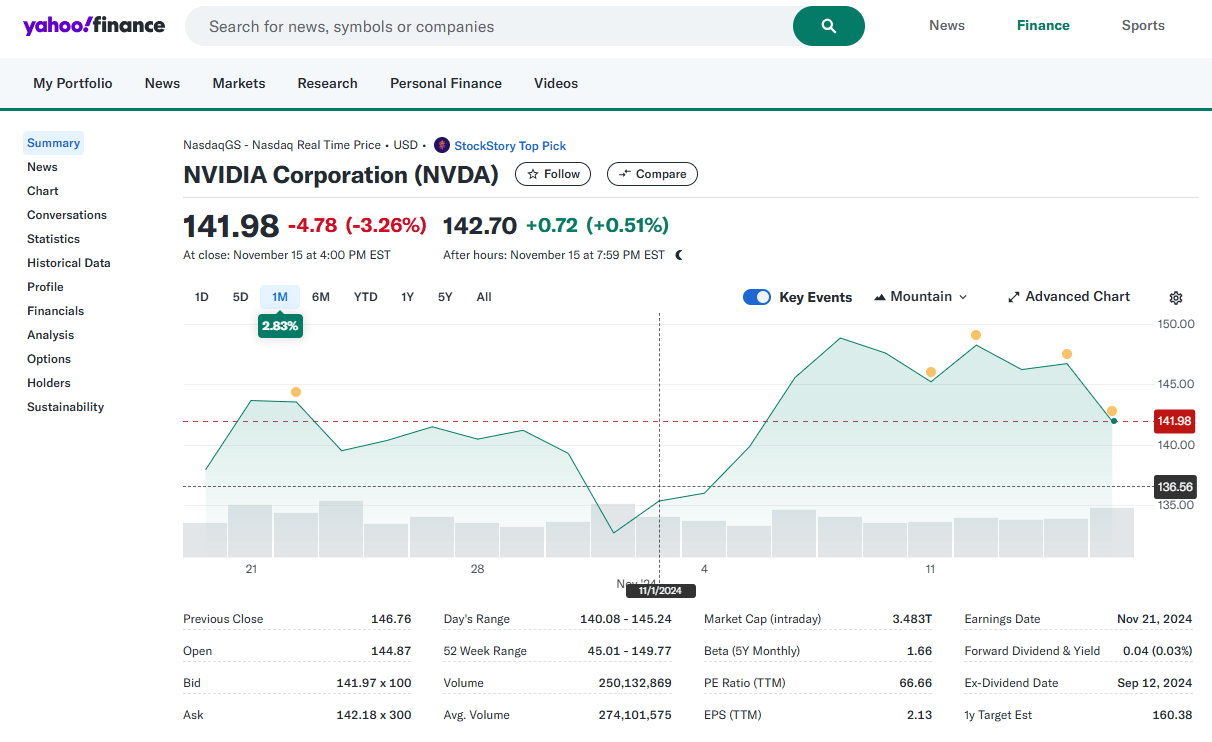

A) Nvidia Corporation (NVDA)

NVIDIA Corporation (NVDA) stands out as a compelling stock pick for the week of November 18, 2024, due to several key factors:

1. Anticipated Strong Earnings Report

NVIDIA is scheduled to release its third-quarter earnings report on November 20, 2024. Analysts project a significant 82% year-over-year increase in sales to $33.1 billion and an 89% rise in net income to $17.4 billion. This robust growth is primarily driven by the escalating demand for AI chips, particularly the new Blackwell AI chip.

2. Dominance in the AI Chip Market

NVIDIA maintains a commanding 95% market share in AI training and inference chips for data centers. The company's strategic focus on AI infrastructure has positioned it as a leader in the semiconductor industry, with its products being integral to various AI applications.

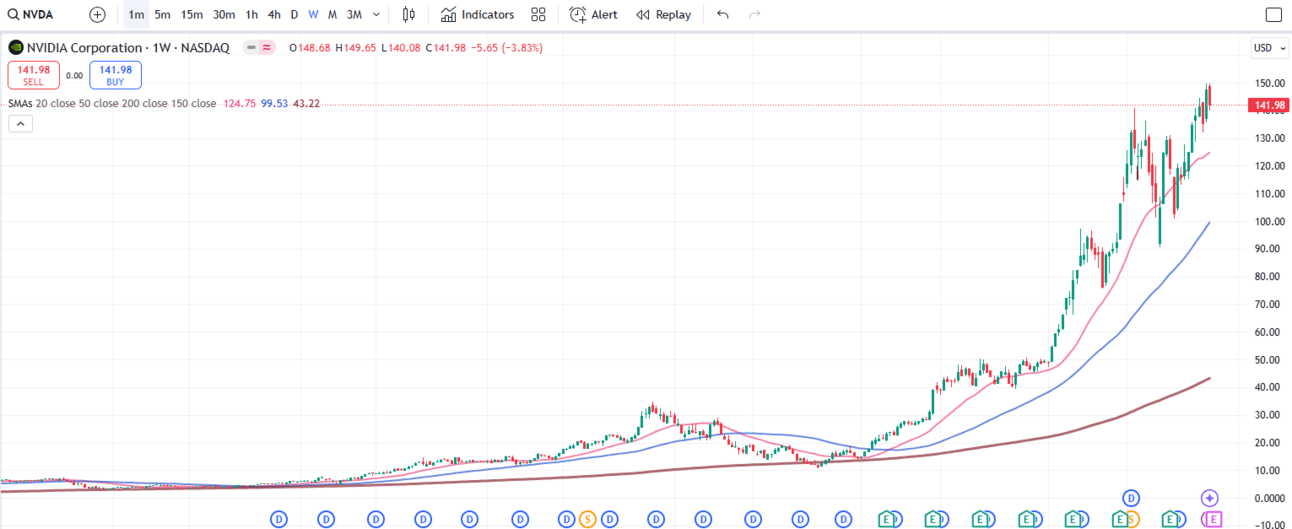

3. Stock Performance and Analyst Confidence

Year-to-date, NVIDIA's stock has surged nearly 200%, reaching a market value of $3.6 trillion. Analysts remain bullish, with several raising their price targets ahead of the upcoming earnings report. For instance, Mizuho increased its target from $140 to $165, reflecting confidence in NVIDIA's growth trajectory.

4. Technical Indicators

From a technical analysis perspective, NVIDIA's stock has demonstrated strong momentum. The stock has risen by 2.09% over the past day, 3.73% over the past five days, and 10.66% over the past month. Year-to-date, it has gained 201.13%, indicating sustained investor confidence.

5. Strategic Product Developments

The introduction of the Blackwell AI chip is expected to further solidify NVIDIA's position in the AI market. This new chip is anticipated to enhance power efficiency and computing capabilities, catering to the growing demand for advanced AI applications.

In summary, NVIDIA's anticipated strong earnings, dominance in the AI chip market, impressive stock performance, positive technical indicators, and strategic product developments make it a top stock pick for the week. Investors should, however, conduct their own research and consider market conditions before making investment decisions.

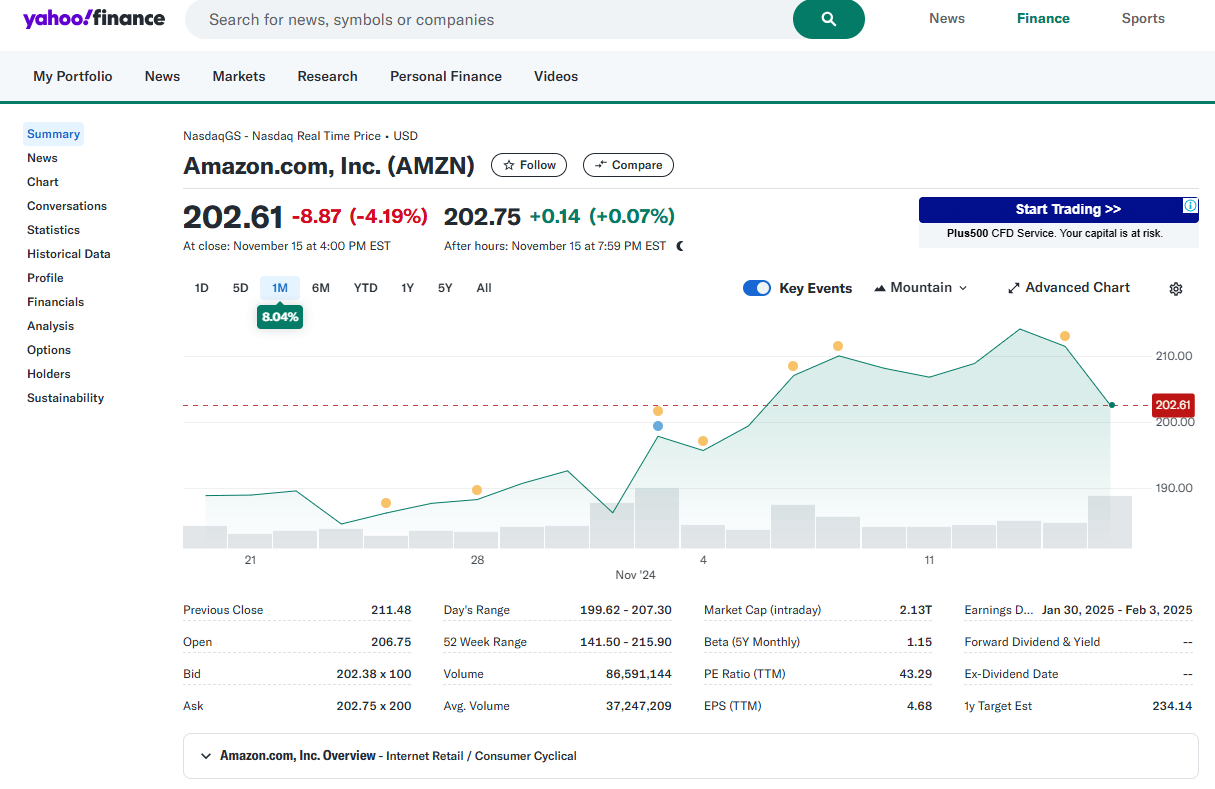

B) Amazon.com INC (AMZN)

Amazon.com Inc. (AMZN) has demonstrated robust performance, making it a compelling stock to consider this week.

1. Strong Financial Performance

In the third quarter of 2024, Amazon reported earnings per share of $1.43, surpassing analysts' expectations of $1.14. The company's revenue reached $158.9 billion, marking an 11% year-over-year increase. Notably, Amazon Web Services (AWS) experienced a 19% revenue growth, the fastest in seven quarters, highlighting the company's strength in cloud computing.

2. Positive Analyst Outlook

Analysts maintain a favorable view of Amazon's stock. Approximately 94% have a buy rating, with an average target price of $232.72, indicating a potential 19% upside from current levels. This consensus reflects confidence in Amazon's growth prospects and market position.

3. Technical Indicators

From a technical analysis perspective, Amazon's stock has shown strong momentum. The stock has risen by 15.09% compared to the previous week, and the month change is a 21.90% rise. Over the last year, Amazon has shown a 46.18% increase.

4. Strategic Initiatives

Amazon continues to innovate and expand its services. The recent launch of "Amazon Haul," a discount e-commerce service, aims to compete with platforms like Temu by offering products priced below $20. This initiative is expected to attract cost-conscious consumers and drive additional revenue.

5. Market Position and Diversification

Amazon's dominance in e-commerce, cloud computing, and digital advertising provides a diversified revenue stream, reducing reliance on any single segment. The company's ability to adapt to market trends and consumer preferences positions it well for sustained growth.

In summary, Amazon's strong financial performance, positive analyst outlook, favorable technical indicators, strategic initiatives, and diversified market position make it a top stock pick for the week.

Valuable Resources

Trade Smarter with these Free, Daily Stock Alerts

It’s never too late to learn how to master the stock market.

You’ll receive daily trade alerts sent directly to your phone and email detailing the hottest stock picks.

The best part? There’s no cost to join!

Expert insights will be at your fingertips instantly.

Extra Insights

Final Takeaways

As we close this week’s edition, let’s reflect on the importance of seizing opportunities and staying informed in an ever-evolving market. NVIDIA (NVDA) exemplifies what happens when innovation and market dominance align—its leadership in AI chips and strong financial outlook make it a compelling choice for growth-focused investors. With its Blackwell AI chip paving the way for groundbreaking technologies, NVIDIA is a clear standout for those looking to capitalize on the AI revolution.

On the other hand, Amazon (AMZN) continues to show why it’s a powerhouse to watch. Its impressive revenue growth, strong performance in cloud computing, and innovative strategies like “Amazon Haul” demonstrate its ability to adapt and thrive across industries. For investors seeking stability combined with growth potential, Amazon offers a diversified approach to navigating today’s market.

The key takeaway? Staying diversified and forward-thinking is essential in today’s investing landscape. Whether it’s leveraging cutting-edge sectors like AI or relying on established giants like Amazon, having a mix of innovation and stability in your portfolio can position you for long-term success.

As always, remember that smart investing is about aligning opportunities with your goals and risk tolerance. Let these insights guide you as you continue building a resilient, growth-oriented portfolio. Thank you for joining me this week—let’s keep learning, growing, and investing together!

[Live Life Grow Wealth]

DISCLAIMER

I make no representations, warranties, or guarantees, whether expressed or implied, that the content provided is accurate, complete, or up-to-date. Past performance is not indicative nor a guarantee of future returns.

I am an individual content creator and not regulated or licensed by the Monetary Authority of Singapore (MAS) as I do not provide investment services.

All forms of investments carry risks, including the risk of losing your entire invested amount. Such activities may not be suitable for everyone. You are strongly encouraged to seek advice from a professional financial advisor if you have any doubts or concerns.