- Live Life Grow Wealth

- Posts

- Think the Stock Market Is Too Expensive? This Historical Chart Might Change Your Mind

Think the Stock Market Is Too Expensive? This Historical Chart Might Change Your Mind

Today’s Headline

Think the Stock Market Is Too Expensive? This Historical Chart Might Change Your Mind

Hey friends,

I get this question all the time—

“Is the stock market too expensive right now?”

To be honest, it does feel that way sometimes. Prices are up, headlines scream about all-time highs, and investors are worried about buying at the peak. The fear of buying right before a crash is real. I’ve been there too.

But then, I came across one historical chart that totally shifted my mindset. And I want to share that with you today, because it might just change how you see the market as well.

🚀 Automate Your Workflow. Multiply Your Investment Efficiency.

Every smart investor knows this: Time saved = Money earned.

That’s why I’m using Guidde — the ultimate AI-powered tool to create visual step-by-step tutorials in seconds.

Whether you're showing clients how to open a brokerage account, training your team to analyze data faster, or documenting your investing SOPs — Guidde turns hours of work into minutes.

In a game where milliseconds matter and clarity drives conversions, this tool is your edge.

Don’t let inefficiency cost you your next big opportunity.

👉 Click here to try Guidde and make your investing workflow 10x smarter

Create How-to Videos in Seconds with AI

Stop wasting time on repetitive explanations. Guidde’s AI creates stunning video guides in seconds—11x faster.

Turn boring docs into visual masterpieces

Save hours with AI-powered automation

Share or embed your guide anywhere

How it works: Click capture on the browser extension, and Guidde auto-generates step-by-step video guides with visuals, voiceover, and a call to action.

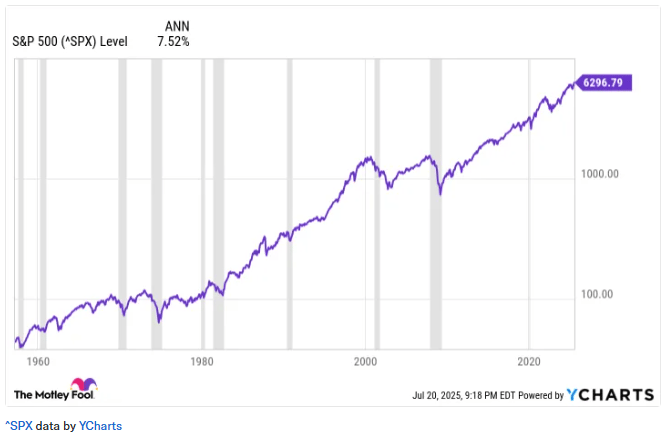

📈 The Chart That Changed Everything

This chart goes way back—over 100 years of stock market history. It tracks the S&P 500 index (which includes 500 of the biggest companies in the U.S.), adjusted for inflation, from as early as the 1920s.

And guess what? Even with crashes like the Great Depression, the Dot-Com bubble, 2008 financial crisis, and COVID-19, the chart still points in one direction: UP.

Yes, there are dips—sometimes big ones. But over the long term, the market keeps climbing. The stock market might zig and zag in the short run, but historically, it rewards patient investors.

🧠 Why This Matters So Much

Let me explain why this chart matters.

Most people try to time the market. They wait for a crash before they invest. Or they sell when prices feel “too high.” But data shows that even when you buy at what seems like a high point, if you hold long enough, you usually end up ahead.

That’s the magic of long-term investing. It’s not about timing the market perfectly. It’s about time in the market.

📊 A Look at the Data (Made Simple)

Here’s a simple way to look at the S&P 500 performance:

In 1980, the S&P 500 was around 120.

In 2000, it crossed 1,400.

In 2024, it’s above 5,000.

That’s more than a 40X increase in 44 years. And that’s not even including dividends!

So even if you bought in 1987 right before Black Monday, or in 2000 right before the Dot-Com crash, if you held on, you still would’ve made great returns today.

💡 The Real Danger: Sitting on the Sidelines

Let me tell you a quick story.

A friend of mine kept waiting for the “right time” to invest. In 2016, he thought the market was too high. In 2019, he thought it was overheated. After the COVID crash in 2020, he was too scared to jump in.

Now it's 2025, and he’s kicking himself. The market has doubled since he first started watching.

Waiting felt safe. But it cost him growth.

🔁 The Market Will Always Feel Expensive

There’s a secret nobody tells you:

The stock market often feels expensive.

Even during big dips, people are scared. During rallies, people think it’s “too late.” There’s always a reason not to invest.

But if you look at history, the market hits new all-time highs all the time. In fact, in a healthy market, it’s normal to see records get broken over and over.

That doesn’t mean a crash is coming—it just means businesses are growing, the economy is expanding, and investors are confident.

🪜 What If You Invested at the Worst Times?

Okay, let’s assume you had the worst luck. You bought right before the 2000 crash and the 2008 meltdown.

Even in that scenario, if you stayed invested through those years, your money would have grown significantly by now. It would’ve been tough emotionally—but financially, you’d still come out ahead.

The key is not panicking during the hard times and letting time do the heavy lifting.

🧮 A Simple Example with Real Numbers

Imagine you invested $10,000 in the S&P 500 in 1990.

You never added another dollar. You just let it grow.

Today, that investment would be worth over $200,000, depending on dividends and the exact index fund.

And all you did was stay put. No fancy strategy. No timing the market. Just buy and hold.

🏛️ The Power of Compounding

Let me introduce you to the most powerful force in investing: compounding.

When your investments earn returns, and then those returns earn returns, it snowballs. That’s why the biggest rewards usually come in the final years of holding—not the early ones.

The earlier you start, the more time compounding has to work. And it’s why even small amounts, invested consistently, can grow into something big.

🔁 What to Do When the Market Feels Too High

So, what should you do when the market feels expensive?

Here’s my approach:

Invest regularly. I use dollar-cost averaging, which means I invest a fixed amount every month, no matter what the market is doing.

Think long-term. I focus on where the market will be in 10–20 years, not next week.

Don’t obsess over price. A great business bought today can still beat a cheap stock that goes nowhere.

Stay diversified. I don’t bet everything on one stock or one sector.

Keep cash for emergencies. That way, I don’t have to sell my investments when I need money.

🧠 Psychology: The Biggest Battle

Let’s be honest. Investing isn’t just math—it’s emotions.

It’s scary to put your money into something that can go down tomorrow. But fear is normal. It’s part of the process.

The biggest challenge isn’t picking the perfect stock. It’s learning how to stay calm when the market dips.

And the historical chart I mentioned earlier? It reminds me that patience pays off.

🤯 Don’t Forget Inflation

Some people say, “Why invest when I can just save?”

But inflation slowly eats away at your cash. What costs $1 today might cost $1.50 in 10 years. If your money isn’t growing, it’s losing value.

Investing helps you stay ahead of inflation. Historically, the stock market has returned about 7% annually after inflation. That’s why the long-term chart rises over time—it shows real growth.

✍️ Final Advice (From Me to You)

If you're feeling unsure, you're not alone. But here’s my advice:

Start small. You don’t have to go all-in today.

Be consistent. Make investing a monthly habit.

Stay patient. Great things take time.

Zoom out. When in doubt, look at the long-term chart.

You don’t need to predict the future. You just need to participate in it.

Final Takeaways

The next time someone says the market is “too expensive,” remember this:

History shows that the market always looks expensive in the moment—but over time, it keeps rewarding those who stick with it.

The best time to plant a tree was 20 years ago. The second-best time is today.

Don’t wait for a perfect moment. Start now, start small, and let time do the rest.

I believe in you. Let’s grow wealth the smart, steady way—together.

Until next time,

Your friend in finance

[Live Life Grow Wealth]

Recommendations Section

|

|

|

DISCLAIMER

I make no representations, warranties, or guarantees, whether expressed or implied, that the content provided is accurate, complete, or up-to-date. Past performance is not indicative nor a guarantee of future returns.

I am an individual content creator and not regulated or licensed by the Monetary Authority of Singapore (MAS) as I do not provide investment services.

All forms of investments carry risks, including the risk of losing your entire invested amount. Such activities may not be suitable for everyone. You are strongly encouraged to seek advice from a professional financial advisor if you have any doubts or concerns.