- Live Life Grow Wealth

- Posts

- "Brace Yourself: Is a Major Market Correction Coming in Early 2025?"

"Brace Yourself: Is a Major Market Correction Coming in Early 2025?"

Today’s Headline

Potential Market Correction in Early 2025: What It Means and How to Prepare

The stock market has been on a rollercoaster over the last few years, marked by rapid recoveries, record highs, and a fair share of volatility. As we inch closer to 2025, whispers of a potential market correction are getting louder. Analysts, investors, and even casual observers are wondering: could the market take a sharp turn early next year? And more importantly, what should you do about it?

When I first heard about the possibility of a correction in 2025, I felt a mix of curiosity and concern. A market correction—a decline of at least 10% from recent highs—can feel unsettling. But here’s the thing: corrections are a natural part of the market’s cycle. Instead of fearing them, smart investors use these moments to adjust their strategies and seize opportunities.

Today, I want to unpack what a potential market correction in 2025 might look like, why it could happen, and how you can prepare for it.

"Stay ahead in the investment world with The Daily Upside—your daily dose of smart financial insights. Click here to uncover the edge savvy investors rely on!"

Savvy Investors Know Where to Get Their News—Do You?

Here’s the truth: there is no magic formula when it comes to building wealth.

Much of the mainstream financial media is designed to drive traffic, not good decision-making. Whether it’s disingenuous headlines or relentless scare tactics used to generate clicks, modern business news was not built to serve individual investors.

Luckily, we have The Daily Upside. Created by Wall Street insiders and bankers, this fresh, insightful newsletter delivers valuable insights that go beyond the headlines.

And the best part? It’s completely free. Join 1M+ readers and subscribe today.

What is a Market Correction?

Before diving into the specifics of 2025, let’s clarify what a market correction is. A market correction happens when stock prices fall by at least 10% from their recent peak. It’s not as severe as a bear market (a decline of 20% or more) but enough to catch the attention of investors.

Corrections happen for various reasons—economic slowdowns, geopolitical tensions, rising interest rates, or even market overvaluation. While they can be unsettling, corrections are often seen as a way for the market to “reset” and find a healthier balance.

Why a Correction Might Happen in Early 2025

Several factors suggest that the market could face a correction early next year. Here’s a closer look at what’s driving these concerns:

1. Economic Uncertainty

Global economies have been grappling with inflation, high interest rates, and slowing growth. While some regions have shown resilience, others are on the brink of recession. A prolonged economic slowdown could trigger a correction.

2. Overvaluation in Stocks

Many stocks have reached sky-high valuations, particularly in the tech sector. When prices outpace earnings growth, the market often adjusts to bring valuations back in line.

3. Rising Interest Rates

Central banks, including the U.S. Federal Reserve, have been raising interest rates to combat inflation. Higher rates increase borrowing costs for companies and consumers, which can slow economic growth and hurt stock prices.

4. Geopolitical Risks

Ongoing tensions in regions like Eastern Europe and Asia could create uncertainty. Markets don’t like uncertainty, and geopolitical risks often lead to sell-offs.

5. Investor Sentiment

After years of strong market performance, investors might start to take profits or move into safer assets like bonds. This shift in sentiment can create downward pressure on stocks.

What Could a Correction Look Like?

If a correction happens in early 2025, it could unfold in several ways:

Broad-Based Decline

A widespread correction could see major indices like the S&P 500, NASDAQ, and Dow Jones falling 10% or more. All sectors might take a hit, though some may fare better than others.

Sector-Specific Correction

Certain sectors, particularly those with overvalued stocks like tech or growth companies, might see sharper declines. Defensive sectors like utilities or consumer staples could hold up better.

Short-Term Volatility

Corrections are typically short-lived, lasting weeks or months. However, the volatility during this time can be nerve-wracking for investors.

Should You Be Worried?

While a correction might sound alarming, it’s important to keep things in perspective. Here’s why:

Corrections Are Normal

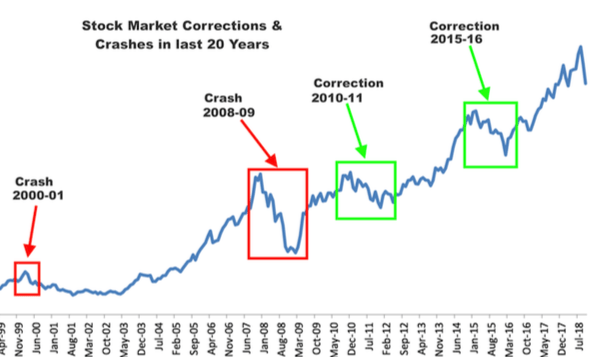

The market can’t go up forever. Corrections are a natural part of the investing cycle and often signal a healthier, more sustainable market.

Opportunities for Long-Term Investors

For long-term investors, corrections are a chance to buy quality stocks at discounted prices. Think of it as a sale on the investments you believe in.

Markets Tend to Recover

Historically, the market has always bounced back from corrections and even bear markets. The key is to stay patient and avoid panic selling.

How to Prepare for a Potential Market Correction

The best way to face a market correction is to be prepared. Here’s how:

1. Review Your Portfolio

Check your portfolio to ensure it’s diversified across different sectors, asset classes, and geographic regions. A well-diversified portfolio is better equipped to handle volatility.

2. Rebalance if Needed

If certain stocks or sectors have become overweight in your portfolio, consider rebalancing. For example, if tech stocks have grown to dominate your holdings, it might be time to add exposure to other sectors.

3. Focus on Quality Investments

During a correction, high-quality companies with strong fundamentals tend to recover faster. Look for businesses with steady cash flow, low debt, and competitive advantages.

4. Build an Emergency Fund

Having cash on hand gives you flexibility during uncertain times. It also prevents you from needing to sell investments at a loss to cover expenses.

5. Avoid Emotional Decisions

Market corrections can tempt you to sell out of fear. Remember, investing is a long-term game. Stay focused on your goals and avoid reacting to short-term noise.

6. Keep an Eye on Opportunities

A correction is a great time to buy stocks at a discount. Create a watchlist of companies you’d like to invest in and be ready to act if prices drop.

Lessons from Past Corrections

History is full of market corrections, and each one has taught us valuable lessons:

The 2020 COVID Crash: Markets dropped sharply but recovered quickly thanks to government stimulus and low interest rates. Lesson: Stay invested; recoveries can happen faster than expected.

The 2008 Financial Crisis: A prolonged downturn that shook the global economy. Lesson: Diversification and patience are crucial during deep corrections.

The Dot-Com Bubble: Overvalued tech stocks collapsed in the early 2000s. Lesson: Avoid chasing hype and focus on valuations.

What to Watch in Early 2025

To stay informed, keep an eye on these indicators as 2025 approaches:

Economic Data

Look for signs of slowing growth, rising unemployment, or persistent inflation.

Corporate Earnings

Pay attention to how companies perform. Declining earnings could signal trouble ahead.

Central Bank Policies

Monitor interest rate decisions and statements from the Federal Reserve or other central banks.

Investor Sentiment

Keep an eye on market sentiment indicators, such as the Fear & Greed Index or volatility indices like the VIX.

Final Takeaways

A potential market correction in early 2025 is a possibility, but it’s not something to fear. Instead, think of it as an opportunity to reassess your strategy, strengthen your portfolio, and even find new investment opportunities.

Here’s my advice: stay informed, stay diversified, and stay calm. Corrections are a normal part of investing, and those who remain patient and disciplined often come out ahead. Whether the market corrects in 2025 or not, the principles of smart investing will always hold true.

Let’s face whatever comes with confidence and a clear plan. Remember, every challenge in the market is also a chance to grow stronger as an investor. So, are you ready for 2025? Let’s make it a year of smart decisions and new opportunities.

[Live Life Grow Wealth]

DISCLAIMER

I make no representations, warranties, or guarantees, whether expressed or implied, that the content provided is accurate, complete, or up-to-date. Past performance is not indicative nor a guarantee of future returns.

I am an individual content creator and not regulated or licensed by the Monetary Authority of Singapore (MAS) as I do not provide investment services.

All forms of investments carry risks, including the risk of losing your entire invested amount. Such activities may not be suitable for everyone. You are strongly encouraged to seek advice from a professional financial advisor if you have any doubts or concerns.